Key Oveview

- Why It Matters: New customers cost 5 to 25 times more than keeping existing ones. A 5% retention boost can increase profits by 25% to 95%.

- Critical Distinction: Voluntary churn needs human intervention. Involuntary churn needs automated payment retries. Different problems, different solutions.

- Leverage AI to Reduce Churn: AI platforms like Niora analyzes patterns across billing, usage, and support data to flag at-risk accounts instantly, enabling intervention before customers leave.

Most SaaS companies think about customer churn all wrong. They obsess over their churn rate like it’s a final grade on a report card, a number that tells them how badly they failed last month. Frankly, it’s a useless way to look at the problem.

Your business isn’t a schoolhouse; it’s a bucket full of revenue, and churn means it has holes.

Staring at the puddle on the floor doesn’t fix the leaks.

So, what is churn prediction in SaaS?

It’s the process of finding the cracks in the bucket before the water starts pouring out, and then doing something about it.

A huge piece of this is knowing the difference between voluntary churn (a customer chooses to leave) and involuntary churn (a subscription fails because of something silly like an expired credit card).

This guide will break down what predictive churn is, how it works and how modern AI platforms can turn churn signals into actionable warnings.

Understanding Churn Prediction and Its Importance

Before getting into the technical details, we need to agree on why this matters. For any business with recurring revenue, churn prediction isn’t a nice-to-have; it’s a core survival strategy.

What is Churn Prediction in SaaS?

The churn prediction definition is straightforward. It’s a system that uses your own data to forecast which specific customers are likely to cancel their service.

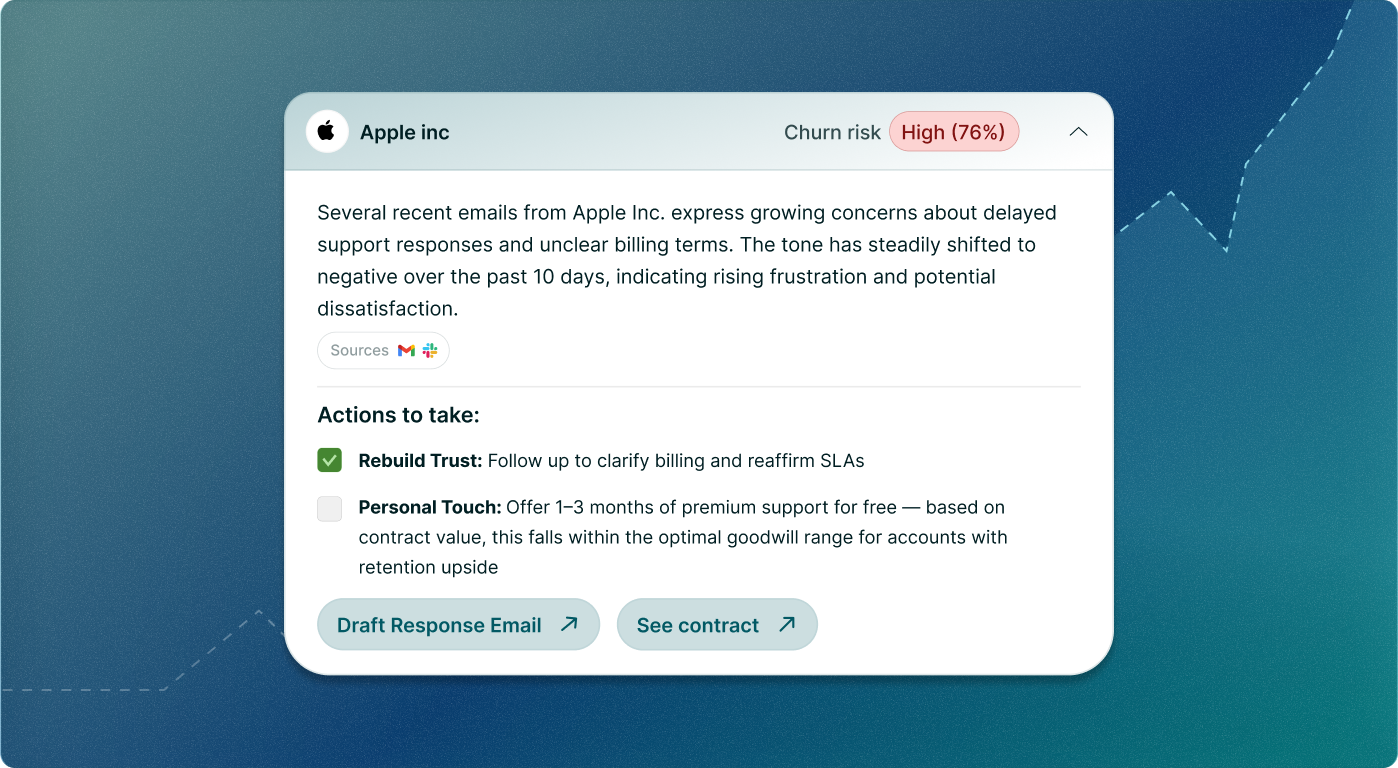

By looking at all kinds of signals, a business can generate a ”churn risk score” or ”company health score” for every single account.

This score is what lets you focus your retention efforts on the customers who are actually wavering.

Unlike digging through old reports, churn prediction is proactive.

It completely changes the conversation from, ”Why did we lose all those customers last quarter?” to, ”Which customers are at risk right now, and what can we do to save them?”

Why Churn Prediction is Critical for SaaS Growth

The benefits of churn prediction in SaaS go way beyond saving a handful of accounts. It’s the foundation of any successful SaaS customer retention strategy.

- Protecting Revenue: The numbers here are just staggering. According to Harvard Business Review, getting a new customer costs anywhere from 5 to 25 times more than keeping an existing one. Proactively saving at-risk accounts is the most direct way to protect your revenue.

- Improving Customer Health: In my experience, the signals that predict churn are usually just symptoms of a bigger problem. Fixing those issues for one at-risk customer often ends up improving your product or service for everyone.

- Increasing Customer Lifetime Value (CLV): This is simple math. When you reduce churn, your customers stick around longer. The longer they stay, the more revenue you generate from each one.

- Boosting Profitability: This is the one that should get every CFO’s attention. Research mentioned by Wharton Executive Education suggests that a mere 5% increase in customer retention can drive profits up by 25-95%.

- Enabling Proactive Intervention:Your customer success teams can stop being reactive. Instead of waiting for a cancellation email, they can engage with at-risk accounts early, offering the right support or training to prove your value and fix the relationship.

Churn Prediction vs. Churn Rate: A Key Distinction

It’s shocking how often these two get confused, but they are fundamentally different tools for different jobs.

| Concept | Focus | Indicator Type |

|---|---|---|

| Churn Rate | A backward-looking metric that tells you the percentage of customers who already left. | Lagging Indicator (what happened) |

| Churn Prediction | A forward-looking process to identify which of your current customers are likely to leave. | Leading Indicator (what might happen) |

On top of this, you absolutely must understand the difference between customer churn vs revenue churn. Losing ten small customers might barely move your customer churn number, but losing one massive enterprise account could cripple your revenue churn. A good churn prediction model has to weigh both.

How AI-Powered Churn Prediction Works

We’ve moved past the era of trying to do this in spreadsheets. Modern churn prediction runs on powerful algorithms and unified data to deliver insights you can actually use.

The Core Mechanics of Predictive Models

So, how does churn prediction work in the real world? The process involves a few key churn prediction model steps.

First, you gather and clean up data from everywhere, your CRM, your billing system, your product analytics.

Then, you use machine learning algorithms to analyze all your historical data, teaching the model to spot the behaviors that led to churn in the past.

Honestly, the success of these models depends almost entirely on the quality of that data. Once the model is trained, it can watch your current customers for those same patterns and assign a risk score.

The specific churn prediction algorithms can range from logistic regression to complex neural networks, as explored in research from journals like Nature.

The Main Data Signals That Predict Customer Churn

The most effective data for churn prediction comes from connecting information across the entire customer journey. The dirty secret is that the best signals are often hidden in plain sight.

- Product Usage & Engagement: These are the obvious ones. A big drop in logins or key feature usage are classic product usage churn signals.

- Contract & Billing Data: I’ve seen companies completely ignore this goldmine. Information hidden in contracts, like upcoming renewal dates, weird payment terms, or recent invoice problems are incredibly powerful predictors.

- Customer Support Interactions: A sudden jump in support tickets or bug reports from a single account is a massive red flag for frustration.

- Customer Engagement & Relationship Health: Are they ignoring your emails? Skipping webinars? Ghosting their customer success manager? These are all important customer engagement churn indicators.

The Role of AI and Machine Learning in Modern Churn Prediction

This is where things get interesting, and frankly, where AI-powered churn prediction leaves manual methods in the dust.

No team of humans can track all those signals, for all your customers, all the time.

It’s an impossible task. AI and machine learning finally make it possible.

- Data Unification: AI platforms can automatically connect to your CRM, ERP, and SaaS platform, pulling everything into one place to create a complete picture that would take a human analyst weeks to build.

- Pattern Recognition: Machine learning churn prediction models find the weird, non-obvious connections in behavior that signal risk. This is sometimes called outlier AI, because it’s great at spotting when something is just… off.

- Real-Time Signals: Instead of a stale monthly report, AI gives you real-time churn signals. You can act the moment a customer’s behavior starts to change. I’ve seen this in action. A B2B SaaS client of ours saw a 35% drop in a key feature’s usage by one of their biggest customers. The AI flagged it instantly, the success team jumped in with some targeted training, and they saved over $50,000 in ARR that was about to walk out the door.

By automating this whole contract-to-cash workflow, Niora’s AI-powered platform for predictive upsell and churn signals pulls all this data together to give you clear, actionable alerts. It turns a defensive chore into a proactive way to grow.

Advanced Concepts in SaaS Churn Prediction

To get really good at this, you have to appreciate the nuances. It’s not just about a single score; it’s about understanding different types of churn and being realistic about the limits of any model.

Voluntary vs. Involuntary Churn: The Critical Difference

This is one of the biggest mistakes I see companies make. They treat all churn as if it’s the same, but the reasons behind it are completely different, which means the solutions are too.

| Churn Type | Description | Prevention Strategy |

|---|---|---|

| Voluntary Churn | A customer consciously decides to cancel. They are unhappy, found a competitor, or their needs changed. | This requires human intervention: better support, proactive engagement, and proving your product’s value. |

| Involuntary Churn | This happens automatically, usually because a payment fails. Think expired credit cards or bank processing errors. | This is a mechanical problem that needs a mechanical solution, like automating dunning management and payment retries. |

Common Challenges and Misconceptions in Churn Prediction

While churn prediction is a game-changer, it’s not magic. You have to understand its limitations to use it well.

- Churn Prediction Accuracy: No model will ever be 100% accurate. The goal is to be right often enough to make your efforts worthwhile. You’ll have false positives (flagging a happy customer) and false negatives (missing a customer who leaves). That’s just part of the process.

- Data Quality: This is the big one. The old saying ’garbage in, garbage out’ has never been more true. If your model is built on messy or incomplete data, its predictions will be useless.

- Dynamic Customer Behavior: People change. A model you trained a year ago might not work today. It needs to be constantly refined with new data.

Beyond Prediction: Advanced Applications and What Churn Prediction Is Not

Truly effective early churn prediction in SaaS gives you more than a risk score. It gives you intelligence you can act on.

A good system doesn’t just tell you a customer might churn; it gives you the probable “why?”.

For instance, it might highlight that they’ve stopped using a feature they once loved, or flag a risky contract term that’s coming up for renewal.

It’s also important to remember what churn prediction is not. It isn’t a substitute for talking to your customers. It’s a tool to help your customer success teams be smarter and focus their valuable time where it will have the biggest impact.

Stop Guessing WhichCustomers Will Leave

Niora’s AI flags at-risk accounts before they cancel, giving you time to save the revenue.

Frequently Asked Questions - Churn prediction

What is the main goal of churn prediction?

The main goal of churn prediction is to proactively identify customers who are at high risk of canceling. This gives a business the chance to intervene and save the account before it’s too late, which directly protects revenue.

Is churn prediction the same as churn rate?

No, they are completely different. Churn rate is a backward-looking metric of how many customers you already lost, while churn prediction is a forward-looking tool to identify which current customers might leave soon.

How accurate are churn prediction models?

The accuracy of churn prediction models depends heavily on the quality of your data and the model itself. No model is perfect, but a well-designed one is more than accurate enough to point your retention efforts in the right direction.

What are the first signals of customer churn?

The earliest signals of customer churn are often a drop in product usage, like fewer logins or using fewer features. Other signs include a sudden increase in support complaints or a general lack of communication with your team.