Know Who’s About to Leave and Who’s Ready to Buy More

Niora’s AI pinpoints accounts most likely to churn and the ones most likely to expand. Act early, protect your revenue, and capture growth before your competitors do.

Why Predictive Upsell & Churn Changes the Game

Customer behavior leaves signals. Niora spots them early so you can protect and grow your revenue.

Churn Prevention

Identify at-risk accounts before they leave and take action fast.

Upsell Opportunities

See which customers are primed to expand, upgrade, or buy more.

Powered by Proven Patterns

Data from companies and customers like yours adds context to predictions.

Act With Confidence

Predictions come with clear reasons so you know exactly what to do next.

What You Get With Predictive Upsell & Churn

Every customer leaves a trail of signals. Niora reads them all to tell you who’s at risk, who’s ready to grow, and why.

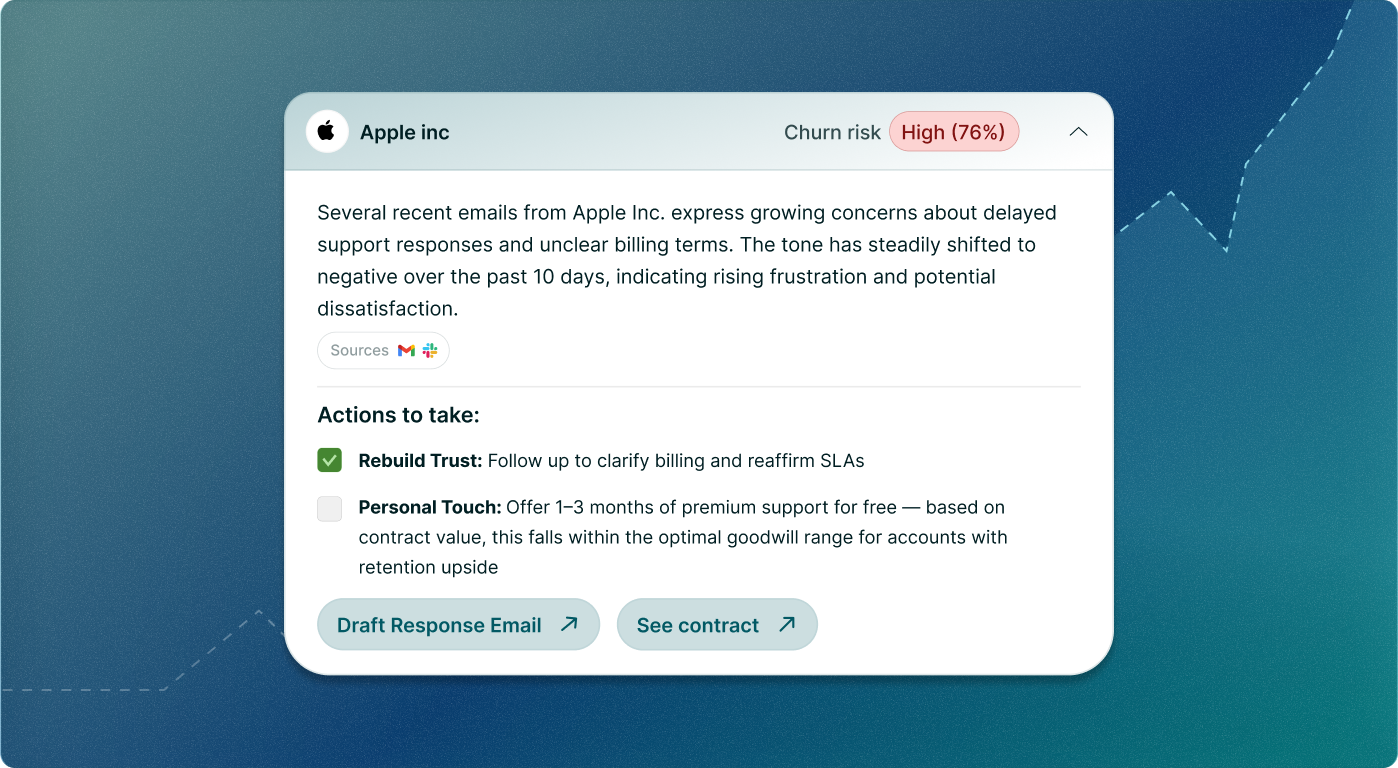

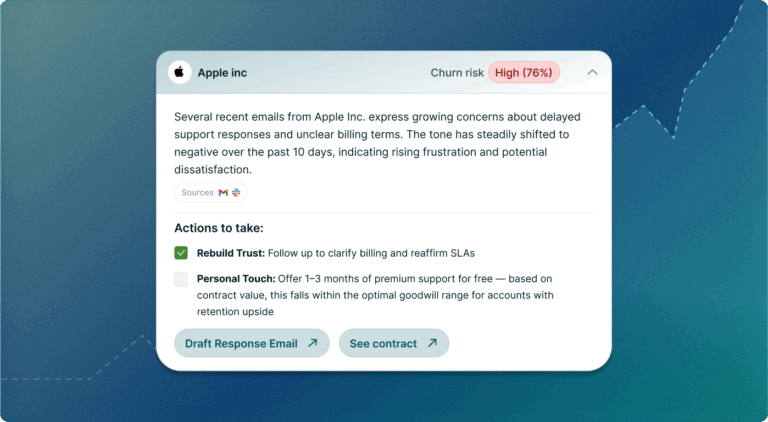

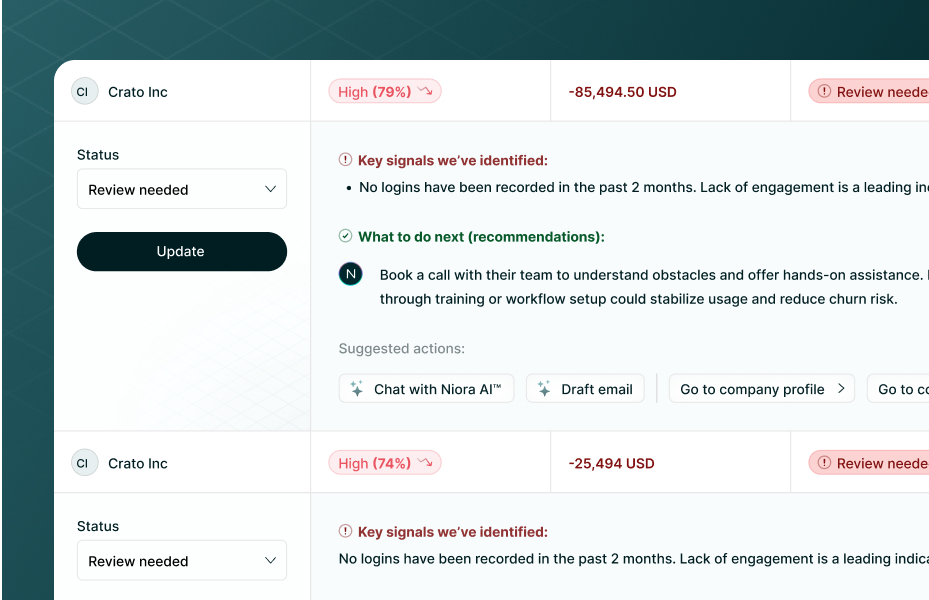

Churn Risk Scoring

AI assigns a health score to every account based on activity, product usage, support history, and payment patterns. See at a glance which customers need attention before they churn.

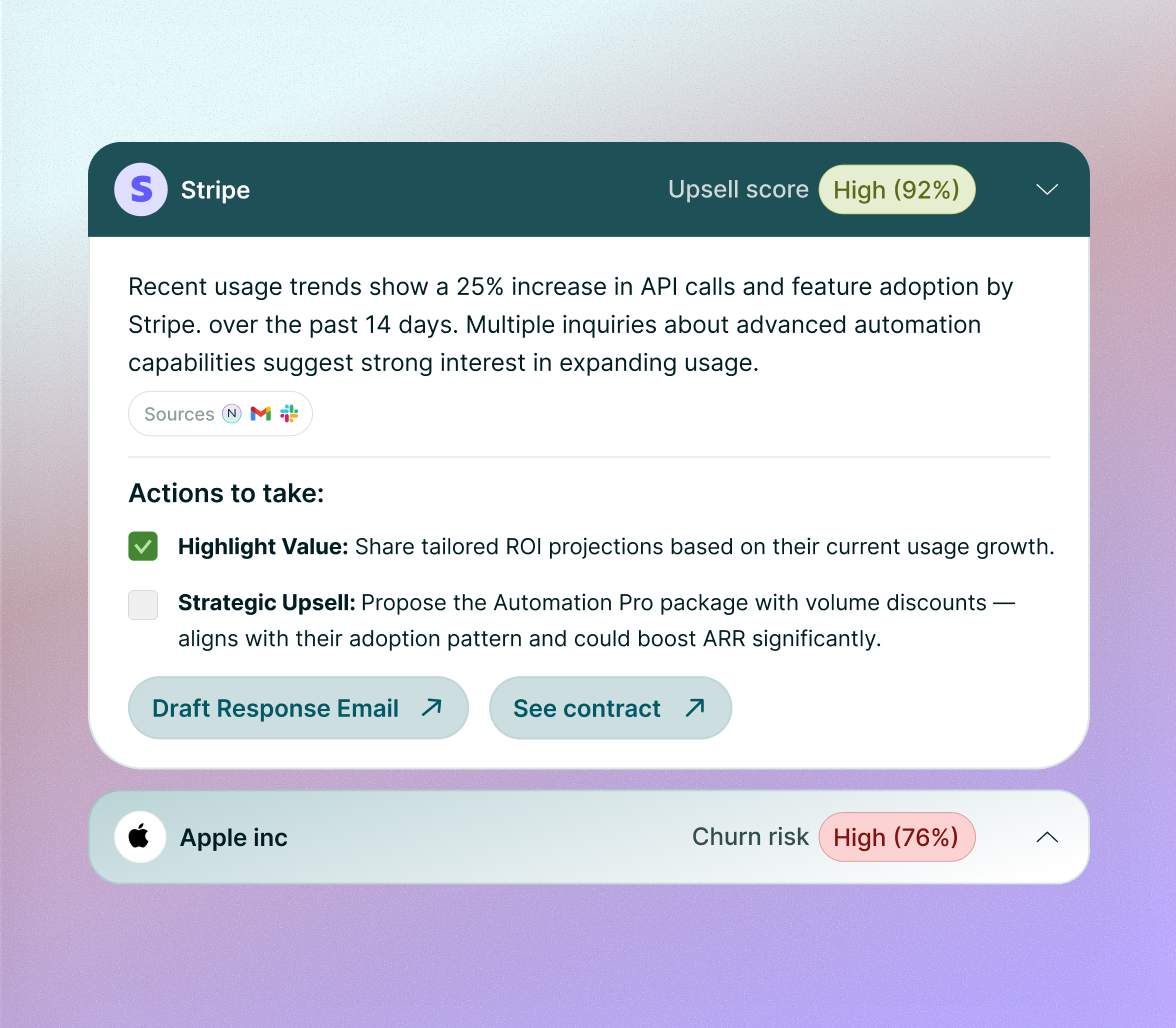

Upsell Signals

Spot customers who are hitting usage limits, showing interest in new products, or matching past expansion patterns.

Clear Action Triggers

Get alerts tied to specific reasons — from declining engagement to contract anniversaries — so your team knows exactly what to address.

Before Niora we managed everything manually and it was messy and time-consuming. Now it just works and we finally have control.

Before Niora, I had to wait weeks for revenue reports. Now I can see ARR, churn risk, and forecasts instantly. It’s completely changed how I make decisions as a CEO.

Using Niora after Chargebee is like going from Blackberry to iPhone. No bloat, just simple and intuitive.

Spot the Risk.

Seize the Opportunity.

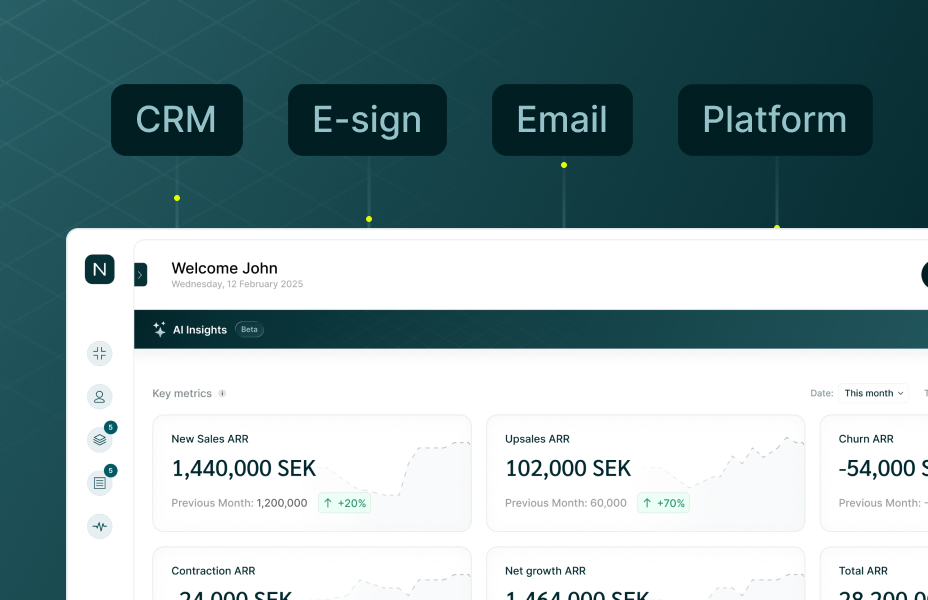

Connect Your Systems

Link the sources that reveal customer behavior. CRM, billing, email activity, and your plattform.

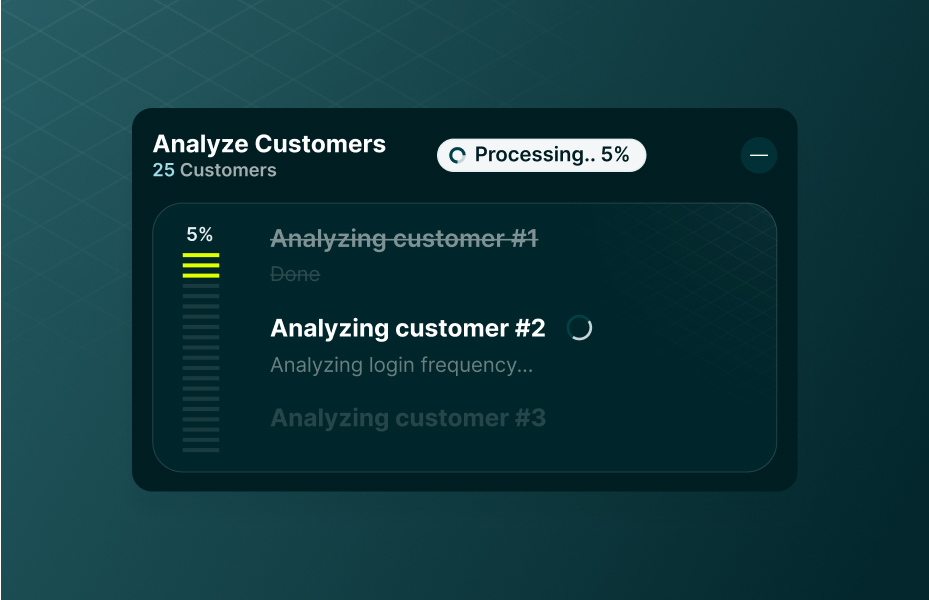

AI Analyzes Behavior

Niora reviews historical patterns, engagement levels, payment history and revenue data to spot churn and upsell signals.

Act Before It Happens

Check the extracted data, approve it, and watch it flow into your CRM, billing, and finance tools.

Frequently Asked Questions

We’ve answered the most common questions so you don’t have to wonder.

How does Niora predict churn?

Niora analyzes patterns like product usage, payment behavior, and activity to assign each customer a health score. When negative signals build up, the system flags that account as at risk so you can act early instead of reacting too late.

Can Niora really spot upsell opportunities?

Yes. By tracking things like usage growth, feature adoption, and expansion patterns from similar customers, Niora highlights accounts that are ready to upgrade or expand. This gives your team a clear view of where to focus for revenue growth.

How accurate are the predictions?

Predictions are based on your actual contract, billing, and usage data, not generic benchmarks. Niora continuously learns from new inputs, making its signals more reliable over time. While no system is 100 percent perfect, it gives you actionable insights you can trust.

What kind of actions can I take once a signal is flagged?

Each churn or upsell signal comes with context and suggested next steps. For example, you might get an alert about declining product engagement with a recommendation to reach out or offer additional support. For upsell, you might see that a customer has exceeded usage limits and is ready for a higher plan.

Do I need a data team to use this?

No. Niora is designed so any CEO, CFO, or account manager can use it without relying on analysts. Insights are presented in plain language, and you can ask Niora AI questions directly if you want deeper context.

How does this compare to dashboards?

Traditional dashboards show you the numbers after the fact. Niora surfaces signals in real time and tells you why they matter. It’s less about looking at charts and more about getting proactive answers you can act on.

Protect Revenue.Unlock Growth.

Know which customers are at risk and which are ready to buy more before it happens.