Key Oveview

Most SaaS companies run their contract-to-cash process by looking backward at last month’s metrics instead of forward at opportunities. AI transforms this administrative burden into a strategic growth engine that predicts what’s coming.

- From Reactive to Proactive: AI spots upsell signals (like accounts hitting usage limits) and churn risks before they impact revenue, enabling prevention instead of damage control.

- Real-Time Revenue Intelligence: Live dashboards show the impact of pricing changes immediately, not next quarter, letting you adjust strategies on the fly.

- Unified Data, Simple Access: AI connects contract, billing, and usage data into one system where teams can ask questions in plain English and get instant answers.Retry

Here’s what’s broken about how SaaS companies handle their contract-to-cash process: They’re running their entire operation by staring into the rearview mirror.

Their contract-to-cash process is a list of chores they did last month: contracts managed, invoices sent, payments collected.

They’re so focused on what just happened that they can’t see the opportunities or risks right in front of them. Frankly, it’s an absurd way to operate when you have the technology to do so much more.

It’s time to stop looking backward and start using a GPS.

By applying an AI-powered co-pilot to your revenue operations, you can transform this entire process. The goal isn’t just to be efficient anymore, it’s to unify contract and financial data to get predictive insights that actually steer your business.

This guide will show you how to turn your contract-to-cash cycle from an administrative burden into a strategic asset that spots upsell and churn signals before anyone else.

Transforming C2C with Revenue Intelligence & Growth Signals

The traditional view of the contract-to-cash cycle is painfully limited. It’s treated like a cost center, a necessary chore to close the books.

But what if that entire process could be your best source of proactive growth?

This is where revenue intelligence comes in. It’s not about reporting on the past; it’s about predicting the future. As noted by industry observers like Clear Function, AI fundamentally changes financial operations by unifying data to drive real growth.

Leveraging Predictive Revenue & Churn Signals

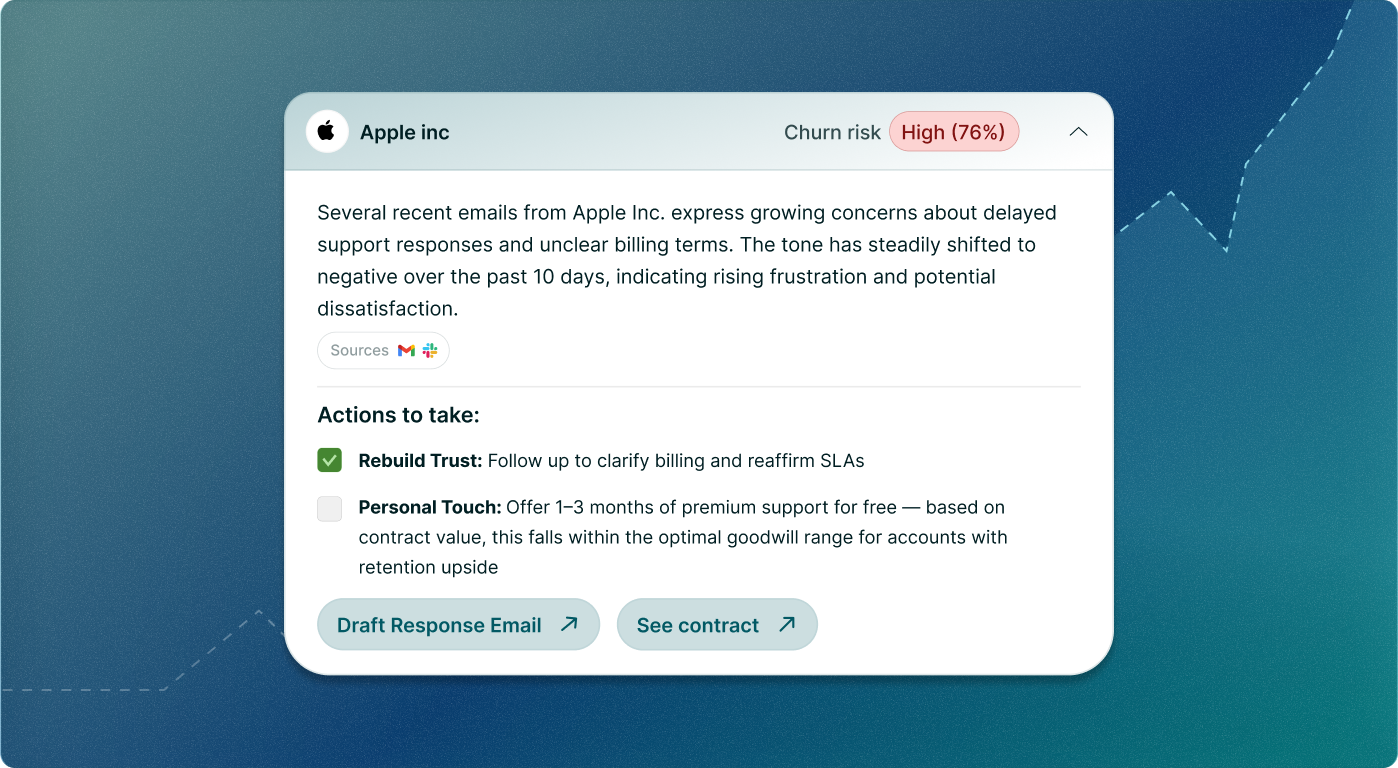

The biggest change I’ve seen in successful revenue operations is the shift from being reactive to proactive. In the past, you’d analyze churn after you lost the customer.

A modern revenue intelligence platform makes that approach obsolete. In my experience, companies using AI in their revenue process don’t just react faster, they prevent problems. For example, Synthesis Systems points out that AI can use predictive analytics to spot at-risk customers, giving you a chance to step in.

I’ve seen this work firsthand, one company I know of saw a 15% increase in upsell conversion rates just by acting on AI-driven signals.

Think about it.

Your system flags an account that’s hit 95% of its usage limit for three months in a row. That’s not just data, it’s a clear upsell signal telling your team exactly who to call. As Sage mentions, AI algorithms are great at this kind of pattern recognition.

This is the whole point of SaaS revenue intelligence: using your own data to make smarter decisions and get a more accurate ARR forecast. While tools like Salesforce Revenue Intelligence offer a starting point, a dedicated platform that unifies all your data gives you a much clearer picture.

Real-time Revenue Reporting for Agile Growth

In the SaaS world, a quarterly report is a history lesson. To actually grow revenue in SaaS, you need real-time revenue reporting. This means a live dashboard showing your critical metrics like ARR, churn, and retention. When your data is unified, you can see the impact of a pricing change the day it happens, not a month later.

This isn’t about speed for the sake of speed, it’s about agility.

Revenue growth automation fueled by live data lets you make better decisions faster. If a specific marketing channel is bringing in highly engaged customers, you can double down on it now, not next quarter.

Proper revenue management today is all about the ability to see what’s happening and act on it immediately.

AI-Powered Automation & Data Unification

The core of this whole transformation is technology, specifically AI-driven automation and a serious commitment to unifying your data.

I’ve seen so many companies try to build high-level analysis on a foundation of messy, siloed data. It never works. AI is what unlocks both the efficiency to clean up that mess and the intelligence to actually profit from it.

AI-Driven Contract & Billing Automation

The path to proactive growth starts with getting the fundamentals right. That means AI contract to cash automation is your first step. Using AI for contract data extraction lets you instantly pull key terms and renewal dates from dense legal agreements, which eliminates the manual errors that cost companies a fortune. This data flows right into AI billing automation, making sure every invoice is perfectly accurate.

This kind of ai automation also applies to AI accounts receivable, where a smart system can manage collections and dunning without human intervention. An intelligent billing platform doesn’t just push out invoices, it optimizes the whole workflow.

This is what modern AI revenue operations is all about: using smart ai automation tools and ai automation services to build an operational backbone you can actually rely on.

Using an AI Assistant for Business Health & Data Unification

The end goal is to unify financial data from every source into one place. But data is useless if you can’t access it.

This is where an AI assistant for business health changes everything. Instead of waiting for a busy data analyst to build a report, your team can just ask questions in plain English.

Imagine your sales manager asking,

”Which enterprise customers in Europe are showing lower usage this month?”

and getting an instant list.

This makes data science accessible to the people who actually need the answers to do their jobs. Good data analysis tools are important, but an AI assistant is what turns a mountain of complex data into simple, actionable intelligence.

SaaS & Subscription Billing Optimization

For any subscription business, the billing platform is the heart of the operation. It touches every customer and every dollar. Getting this part right isn’t just about being efficient. It’s about building a flexible and reliable foundation that can support your growth strategies without causing chaos.

Choosing Your Platform: The Core of SaaS & Subscription Billing

The market for a subscription billing platform is crowded, and most of the major players are perfectly competent at managing recurring payments. Here’s a quick rundown of the usual suspects:

| Platform | Primary Focus | Ideal Use Case |

|---|---|---|

| Stripe Billing | Integrated payments and developer-first APIs for custom workflows. | Businesses already on the Stripe ecosystem or requiring deep API customization. |

| Chargebee | Flexible subscription lifecycle management and revenue operations. | SaaS and subscription businesses needing rapid deployment and feature flexibility. |

| Zuora | Enterprise-grade monetization engine for the ”Subscription Economy.” | Large enterprises with complex, multi-product, and usage-based billing models. |

But here’s the thing most people miss: these platforms are just one piece of the puzzle.

Standalone subscription management solutions handle the transaction, but a truly smart system connects that transaction back to the original contract and forward to the financial reporting.

This is where SaaS billing automation needs to go. The best billing software today is part of a unified system for comprehensive billing and revenue management.

Your cloud based subscription billing solution shouldn’t just be a cash register, it should be a primary data source for your growth engine.

Mastering Contract & Invoice Automation

To really streamline contract to cash in SaaS, the link between the signed contract and the first invoice has to be unbreakable. Good contract automation software ensures the terms you agreed to are the terms you bill for, preventing revenue leakage and angry customer emails. From there, automated invoice generation makes sure billing is on time, every time, which is just basic for maintaining healthy cash flow.

The goal is simple: automate the operational side of billing so completely that your team can forget about it and focus on strategic growth, knowing the foundation is solid.

Revenue OperationsInto a Growth Engine

Frequently Asked Questions

What is AI contract to cash automation?

AI contract to cash automation is the use of artificial intelligence to handle the entire workflow from a signed contract to getting paid. In my experience, its main value comes from eliminating the manual errors in data entry and invoicing that quietly drain revenue over time.

How does a revenue intelligence platform help with subscription revenue growth?

A revenue intelligence platform drives subscription growth by giving you predictive insights instead of just historical reports. It connects all your contract, billing, and usage data to flag real upsell opportunities and detect churn signals so you can get ahead of problems.

Why is real-time revenue reporting important for a SaaS business?

In SaaS, waiting for month-end reports is too slow, which is why real-time revenue reporting is so critical. It lets you see the immediate impact of your decisions, so you can adjust your strategy on the fly instead of waiting weeks to find out something isn’t working.

Can AI predict customer churn?

Yes, AI is very effective at predicting customer churn. It analyzes thousands of data points, like product usage and support history, to spot subtle behavioral changes that signal a customer might be at risk, giving your team a crucial heads-up to intervene.